Hi all,

At the last committee meeting we discussed publishing a monthly financial summary of how MHV’s doing, and hopefully give a layer of transparency to the community regarding the Space’s finances.

I’ve made a summary of all info I’ve thought of so far that could be of public interest, if there’s anything else you might want to know in a following summary please let me know and I can revise it for the next summary, which should be published at the end of May/Start of June

But for now, here’s a summary for our standing as of the end of April/Start of May:

Summary for April 2019

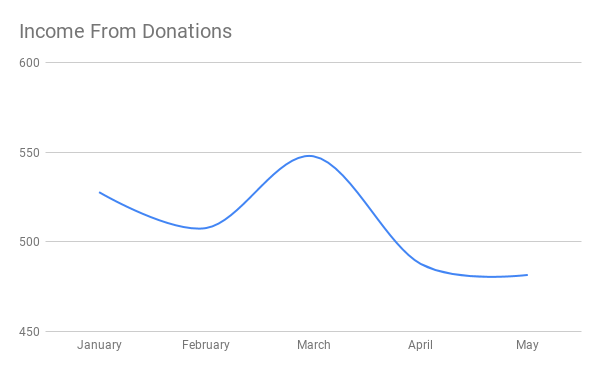

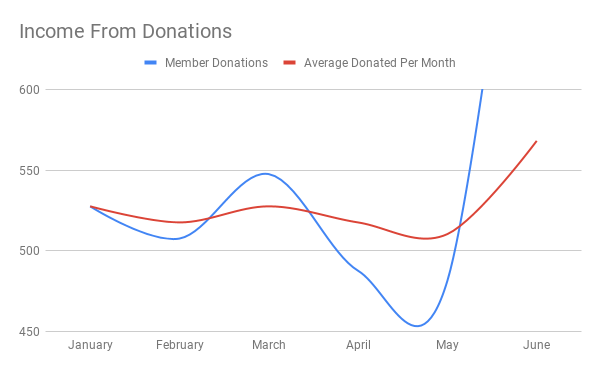

Donations:

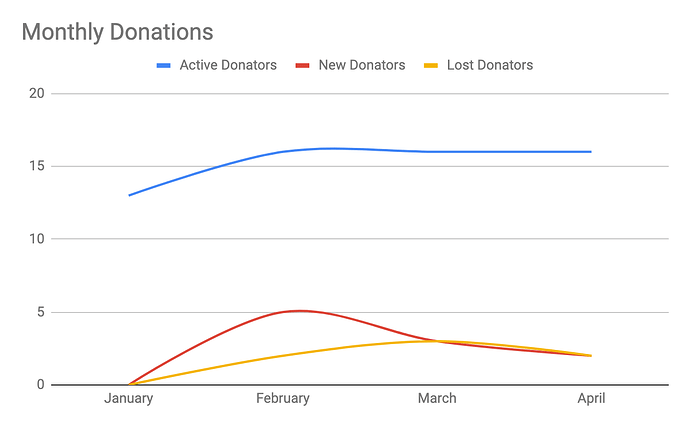

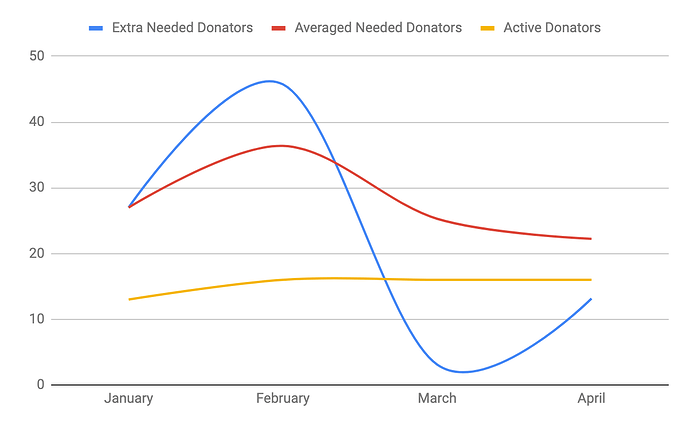

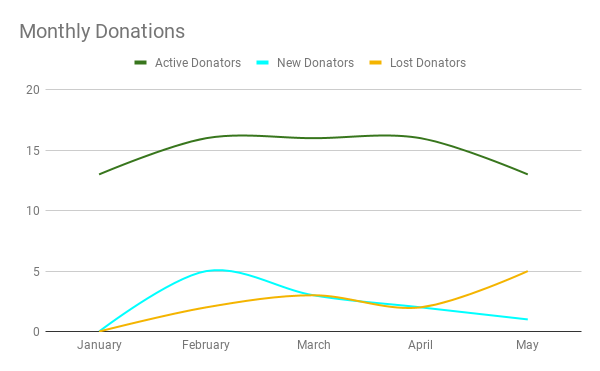

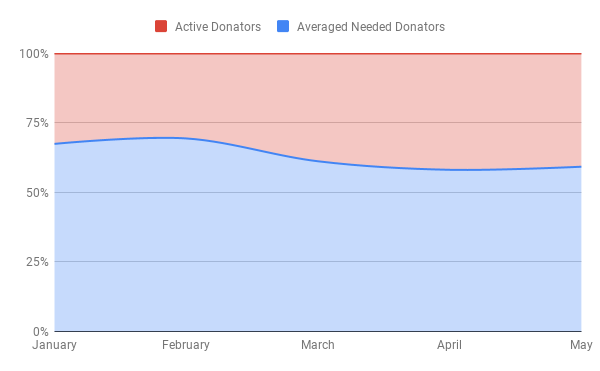

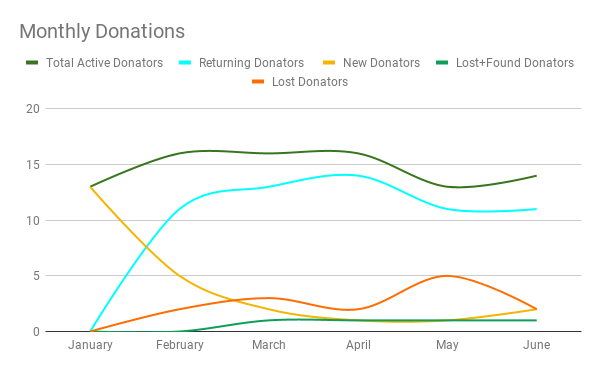

We have 16 active donators, including two new donators, and two lost donators.

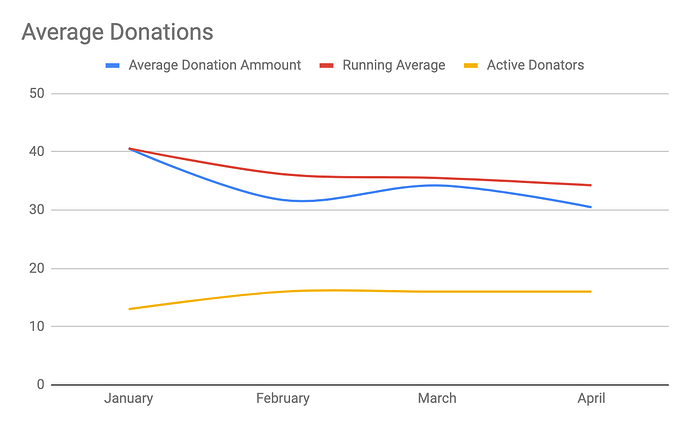

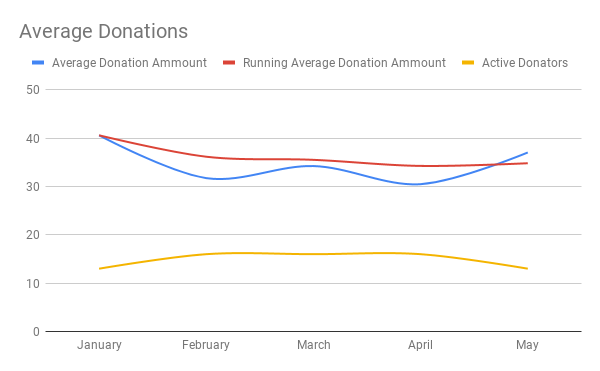

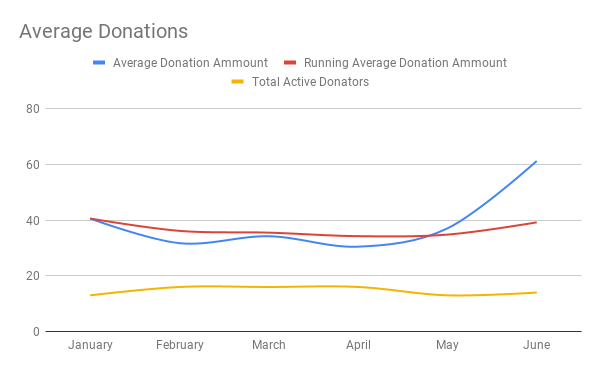

The average donation amount this month was $30.48125, down from last months $34.23125, and the yearly average of $34.25901442.

The peak average donation amount was January, with 13 donators averaging $40.59230769, and the overall peak total donated was March, with 16 donators averaging $ 34.23125

Income and Expenses

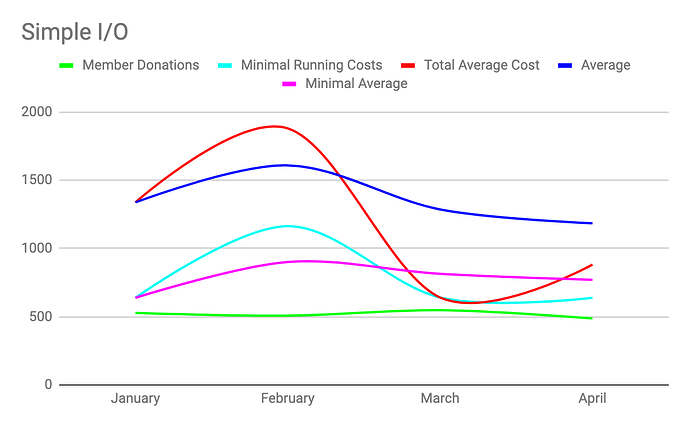

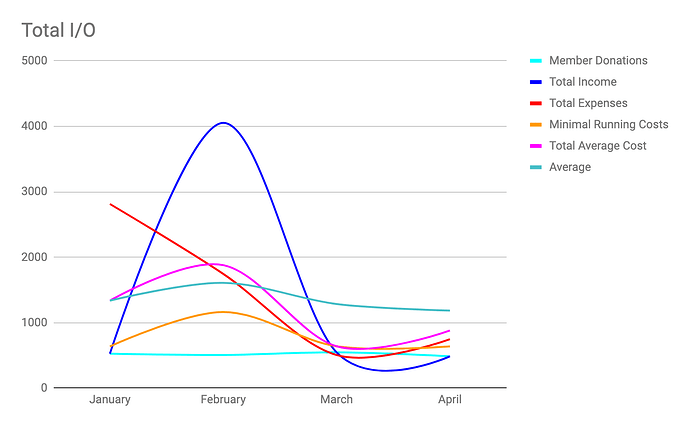

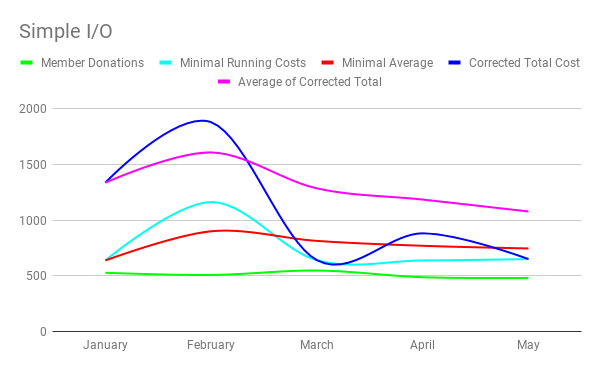

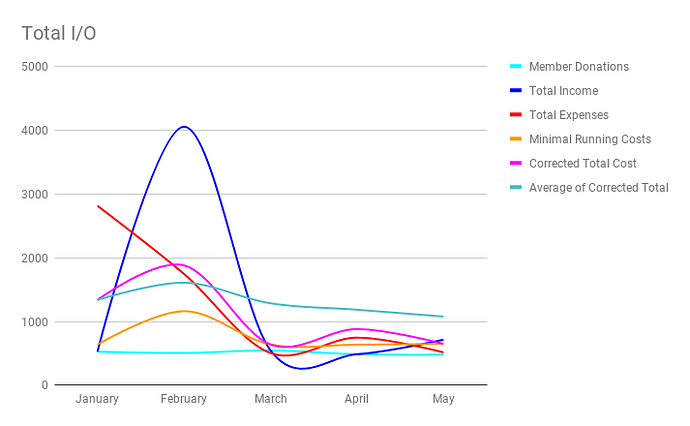

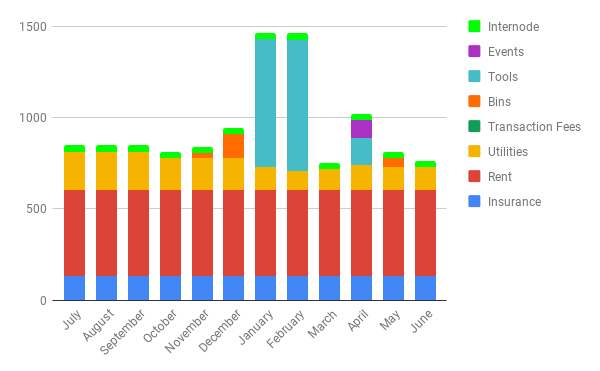

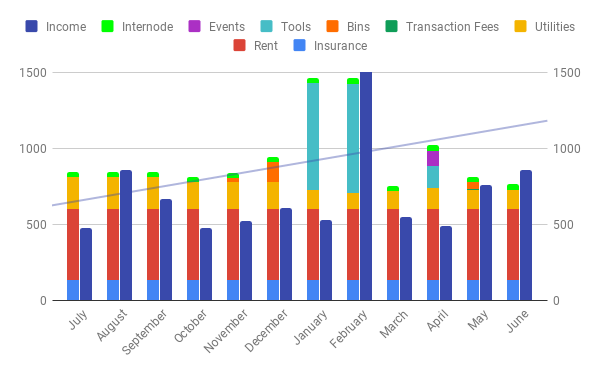

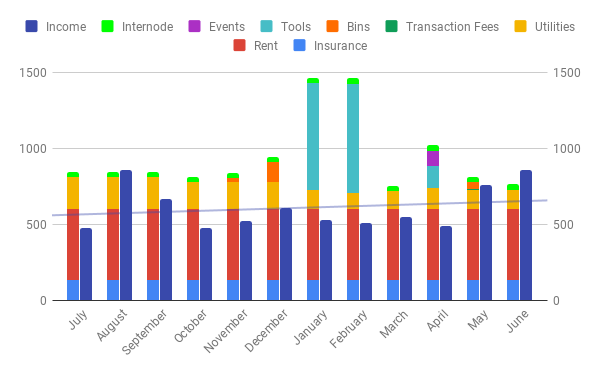

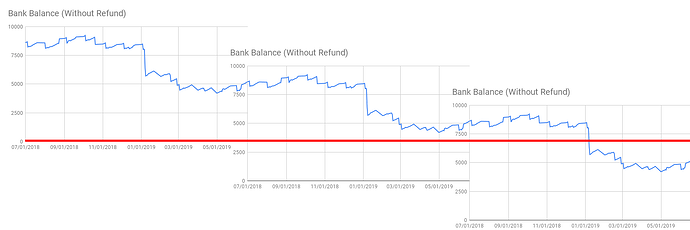

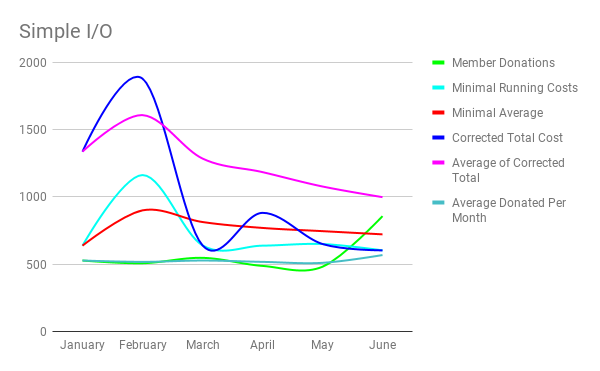

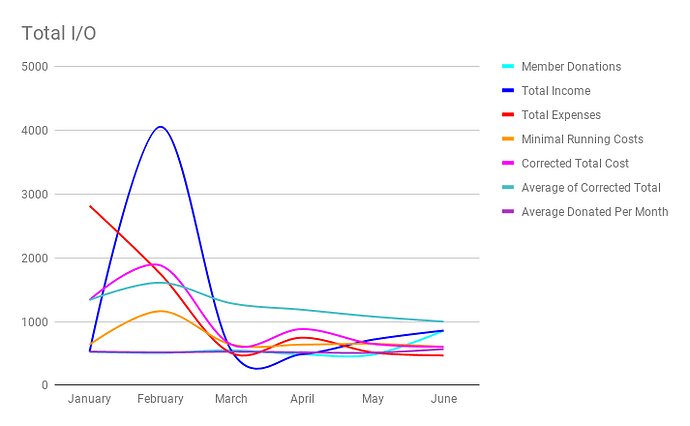

The following graph is most representative of the truth, as it treats monthly and yearly payments differently, by taking any yearly payments, dividing them by 12, and spreading them over the proceeding 12 months. Raw data will follow, but as far as keeping MHV afloat goes, this is the one that matters.

In this case, the green line needs to at least be above the pink line, as this is the average of our absolute minimal operating cost, including nothing other than rent and utilities (the light blue line).

The red line is our raw running cost, factoring and dividing yearly payments, and the dark blue line is the average of this.

The green line needs to get above the dark blue line for us to continue operating as-is.

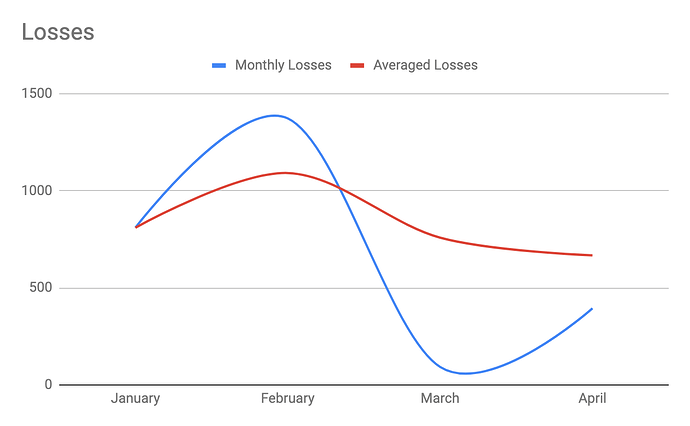

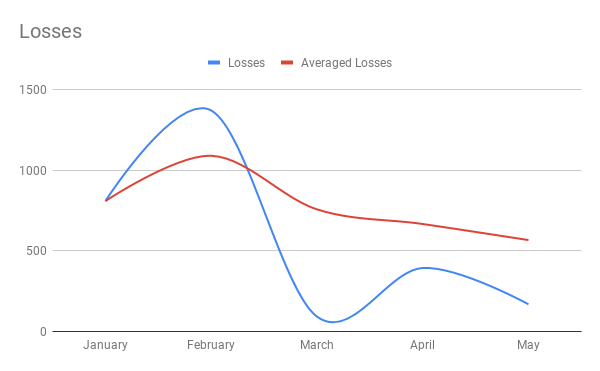

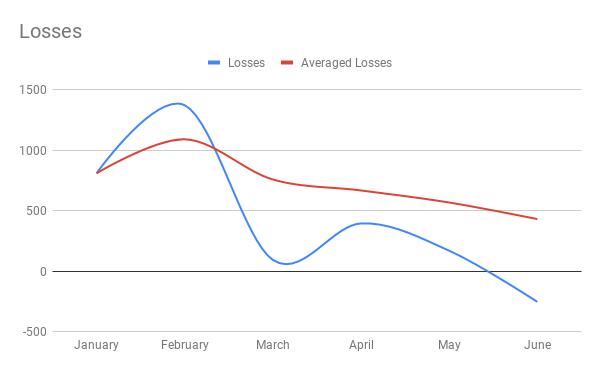

Losses

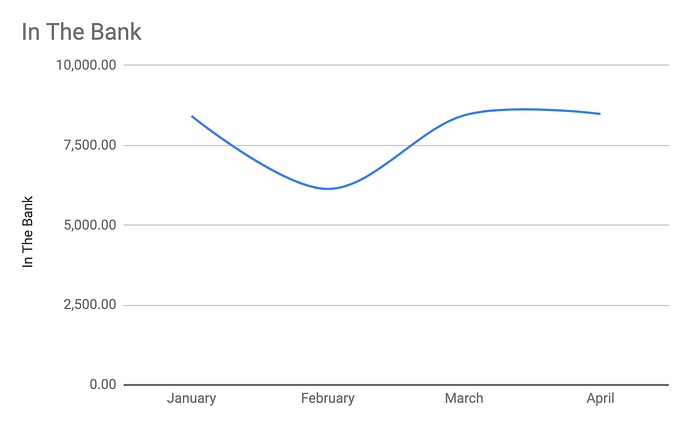

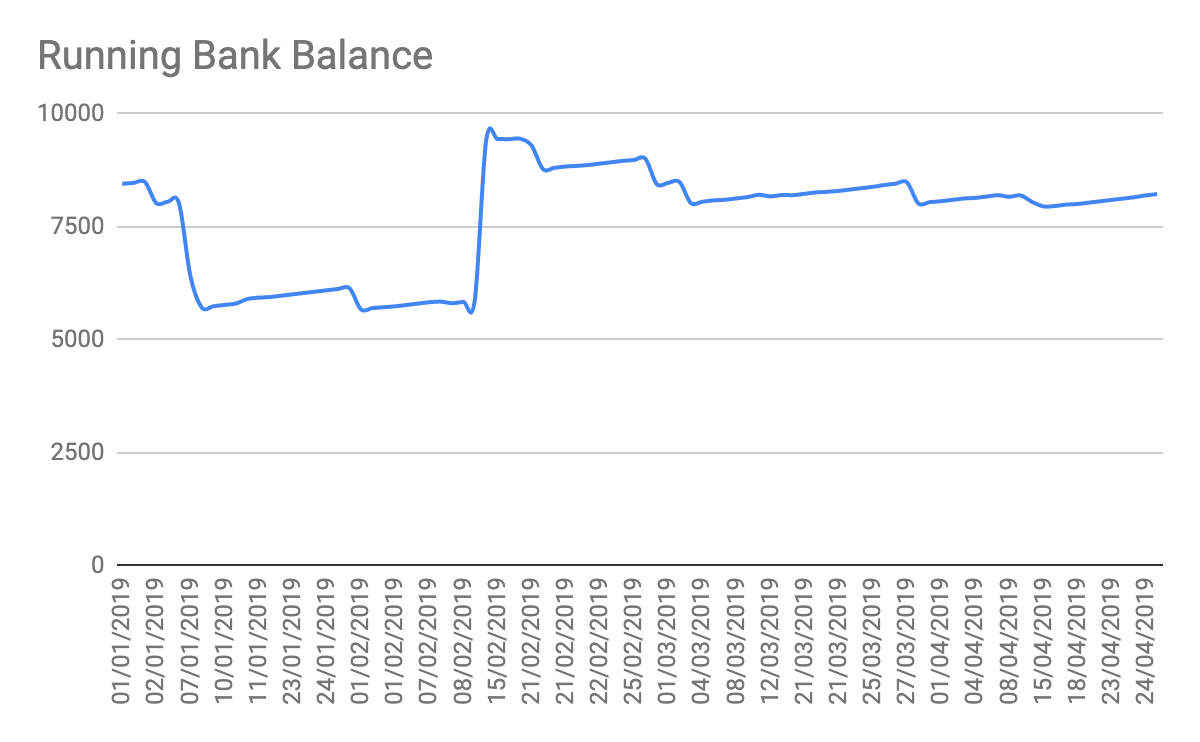

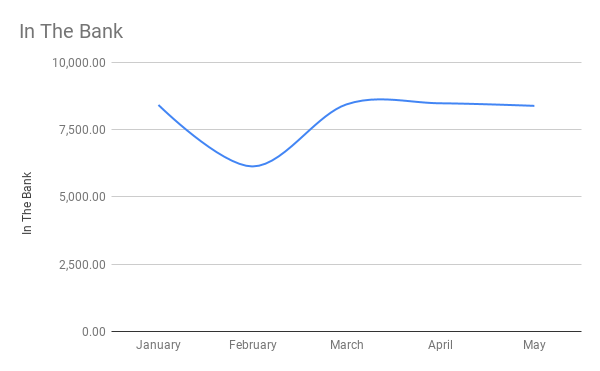

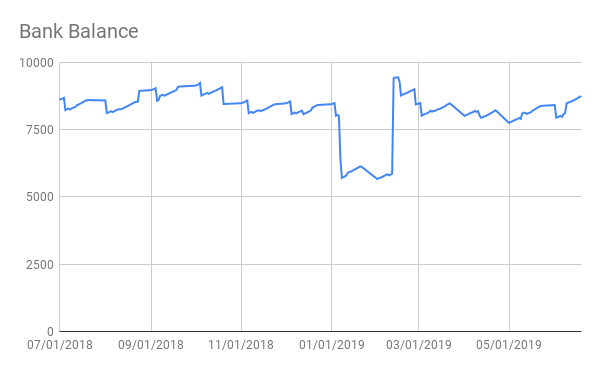

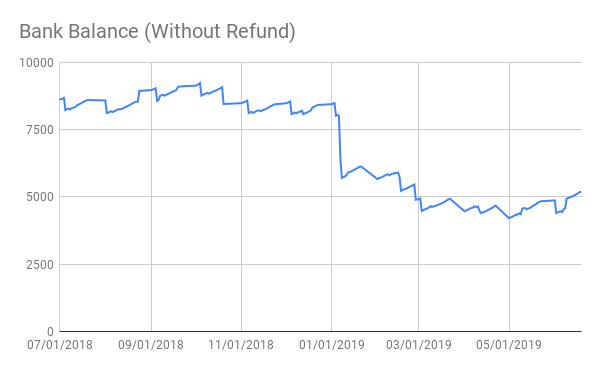

We are currently loosing on average $667.2125 a month, with $8483.14 in the bank, that gives us

12.7 months until our balance will be at zero. This does not factor for reserved money, but that’s a whole can of worms I’m not going into again (Sorry Ben, my bad).

So 12 months is our absolute maximum.

There is, however, a downward trend on losses, however we don’t yet have enough data to work out if it’s just statistical noise.

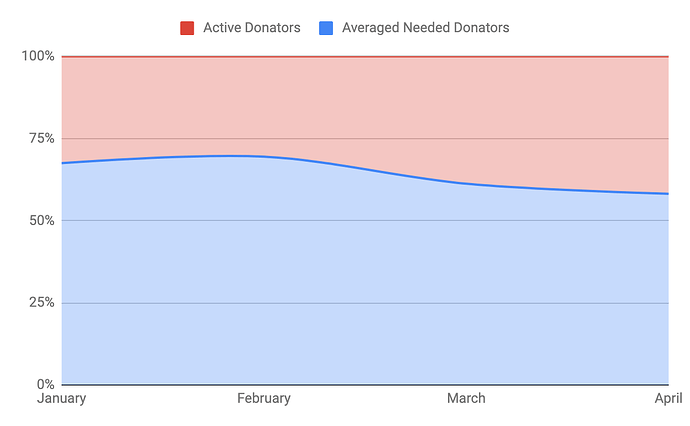

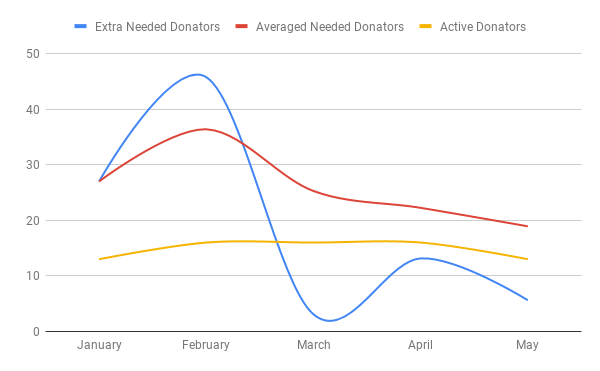

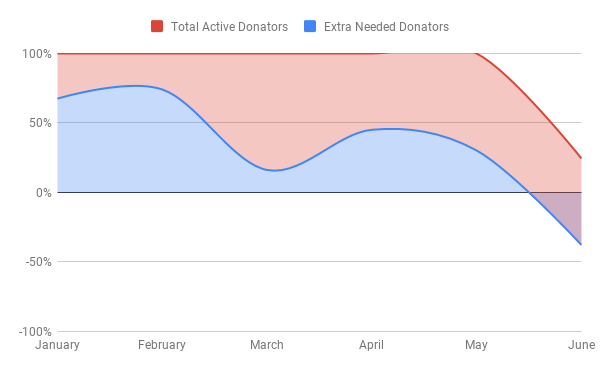

This all said, we’ve got less than half as many people donating as we need.

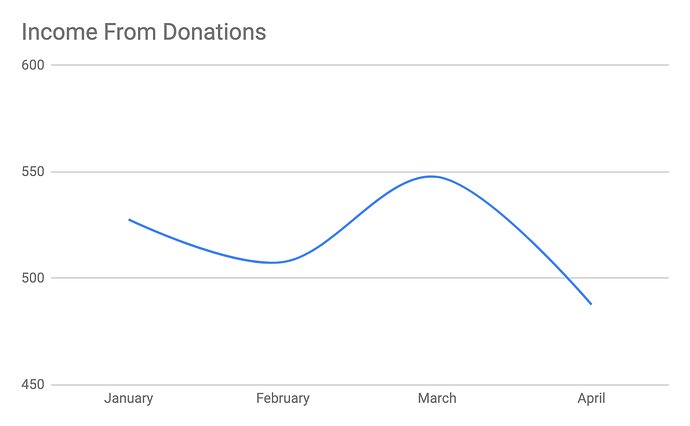

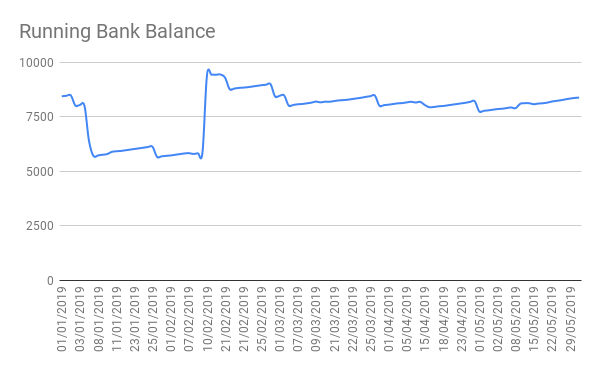

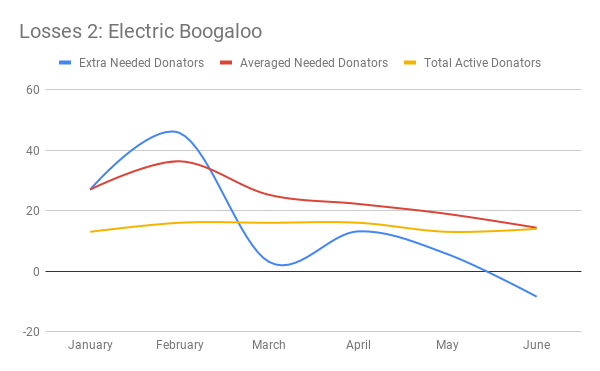

RAW INFO

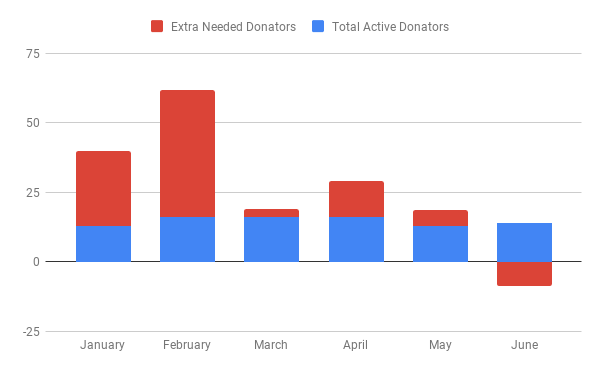

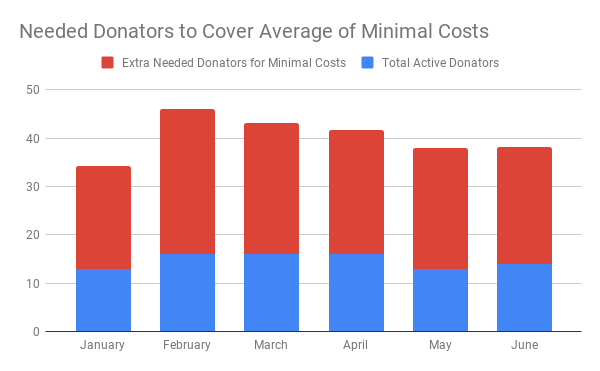

Here’s just some other graphs for you to make use of yourself.

(Keep in mind, this includes things like the ~$3.5k glowforge refund, $1.5k one-off insurance payments, and a whole bunch of other stuff, totally unfiltered.